Whoops! – Are We Seeing and Understanding This Dramatic Move Toward Some PROGRESS?

Author: Roger Herbert CAIB(SA) – Retired Commercial Banker and Past General Secretary of the Banking Association of Southern Africa, Invoice Financing Division.

Introduction

One of the first steps the South African Government of National Unity is taking in its effort to restore PRODUCTIVITY into our country is to amend the National Small Enterprise Act of 1996 to establish a new entity, the Small Enterprise Development Finance Agency, which will incorporate the Small Enterprise Development Finance Agency (SEFA), the Small Enterprise Development Agency (SEDA) and the Cooperative Banks Development Agency (SEDFA).

This step shows us that the State is centralizing its efforts to assist developing enterprises with the various forms of finance that they make available to entrepreneurs.

The Purpose of This Paper

To reveal an additional tool to help Small, Medium, and Large Businesses raise Working Capital to lubricate their financing in their day-to-day trading: Suppliers can benefit, Buyers can benefit and Financiers can benefit using this unique dynamic ecosystem. The State can benefit too!

Why Our Proposal Could Be of Interest to the Small Enterprise Development Agency

It goes without saying that business people in South Africa have been aware that our economy has been in the doldrums greatly for decades, made worse by debilitating corruption that has drained our country’s financial resources.

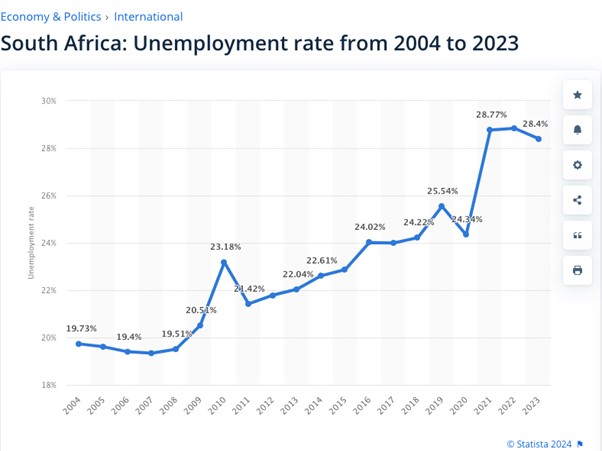

The worst hit in this scenario has been the nation’s workers. Well-known is the fact that our levels of unemployment are among the worst in the world! This graph vividly shows what has happened in this respect over the last twenty years:

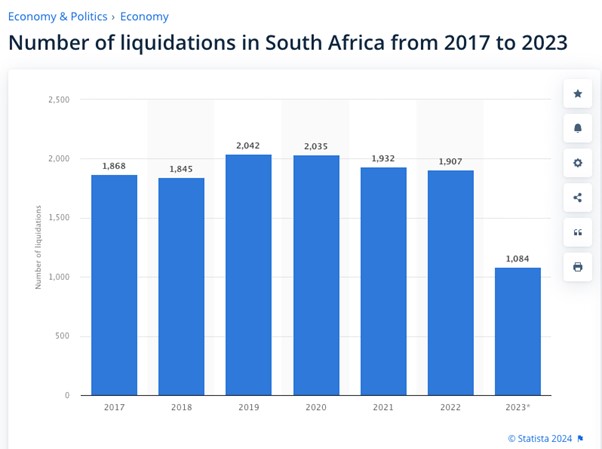

Another source of job losses is the number of insolvencies that have occurred in recent years. Many of these business liquidations could have been avoided if Buyers paid their Suppliers promptly, and if the Financial Sector knew how to rescue ailing businesses more promptly.

The graphic below clearly shows how the disaster of business failure has impacted our economy in the recent past, not forgetting that the trend has been building up for many years before causing banks and other trade financiers to become very cautious in exposing themselves to developing businesses. No wonder the new South African Government of National Unity has realized that drastic steps are needed to restore PRODUCTIVITY, PROGRESS and PROFITABILITY:

If we add up the number of these insolvencies, we get 12713 in seven years. Imagine the number of job losses here and the impact on ordinary families. Really this is a disaster in our country’s affairs!

It is this sad state of affairs that has been on the minds of the directors and their colleagues of the Founders of Cash-Flow Systems for twenty-one years now, resulting in painful Research and Development that has produced the ecosystem you will read about below that can play such an important part in revitalizing the South African economy when the likes of the Small Enterprise Development Finance Agency, the banks, and other financiers come to understand the potential of the information being made available in this paper.

The benefit to the State

Suppose the State gets it right to boost the economy what happens to the rate of taxes that come into State coffers? One does not have to be a Rocket Scientist to know that they fill up, rapidly!

State departments and state-owned enterprises can learn more about Cash-Flow Systems here.

The benefit to banks and other financiers

They do not have to be as cautious as they have been in extending credit because each transaction gets verified and confirmed (validated in other words) BEFORE a financier exposes himself to any risk in financing it.

This means that he can look at markets he, the financier, has not dealt with before.

Not only that, in addition to the usual interest he can earn, there is a transaction fee he can levy.

Financiers can get more information about this at Cash-Flow Systems.

The benefit to Suppliers

Suppliers usually find themselves having to wait far longer than the trade terms they agree with the Buyer. For example, payment 30 days from Statement get agreed upon. However, even creditworthy chain stores and State buyers have a penchant to only pay much later 45, 60, 90 or a hundred and plenty days later! – No Supplier can handle this. Suppliers invariably go into Liquidation because Buyers pay late!

When Suppliers understand and begin to use the ecosystem Cash-Flow Systems provide, the painful wait for creditworthy buyers is over. Suppliers get paid within 24 hours of the validation of the transaction concerned.

Imagine that! – No more waiting for a creditworthy Buyer to pay a Supplier! The Supplier now will have the funds to purchase the requisites he needs to continue his business and pay wages and salaries on time every time!

How can a bona fide Supplier not take advantage of the Cash-Flow System ecosystem?

The benefit to Buyers

Buyers, especially large Purchasers, do not generally realize the power they hold in a national economy.

When they pay late their Suppliers suffer and sometimes end up in insolvency. We all need to avoid this.

Buyers get a bad reputation for paying late. Why does any Buyer want this?

Working with https://cash-flow.systems Buyers can pay Suppliers on time every time – getting the reputation of being a good Buyer! – What a pleasure!

Not only that, by paying early Buyers can usually earn Early Settlement Discounts from their Suppliers. These can be so valuable that if they use the https://cash-flow.systems solution the costs involved could be more than covered!

For any Buyer to enhance his reputation to be classified as a good Buyer, and basically earn enough Early Payment Discounts to cover the costs involved for doing so, never mind the service he would be doing to the national economy, how can any Buyer resist in being part of the https://cash-flow.systems ecosystem?

Accordingly, it is with great pleasure that we invite State officials, banks, and other financiers, Suppliers, and Buyers to not only consider using the benefits of the new ecosystem, https://cash-flow.systems presented but also complete the application forms to establish whether your business can truly benefit from the proposal that has been presented herein.

Roger Herbert – 25 July 2024